Will the ripping up of the current tax code and transforming Britain into a deregulated, tax haven status, make us great again? No one can truly be sure. But that was the motion which was heatedly debated at the second Thomson Reuters Legal Debate for 2017.

The debate was held just a week after the first anniversary of the UK’s Brexit vote, a vote which resulted in the UK filing for divorce from the EU. Over the last 12 months, we’ve seen the British pound take a 14% dive, changes in political leadership, the triggering of Article 50, and constant debate over the future of free trade, funding for public services and what the impact of Brexit will truly be. But regardless of whether people voted for leave or remain, Brexit is happening and now is the time to explore what opportunities it brings and whether luring global business with zero tariffs, radical deregulation and lower taxes could make Britain great again.

In a pre-debate vote, using the Thomson Reuters Convene app, the audience slightly leaned towards the motion that Britain achieving a tax haven status would be a positive move, with 46 per cent in favour of the motion, 38 per cent against the motion and 15 per cent still undecided.

What is a tax haven?

From the outset it seemed the major challenge and debate of the evening was not whether the UK achieving a tax haven status was a good thing for Britain, but rather it was agreeing on the definitions of what a tax haven and tax haven status is?

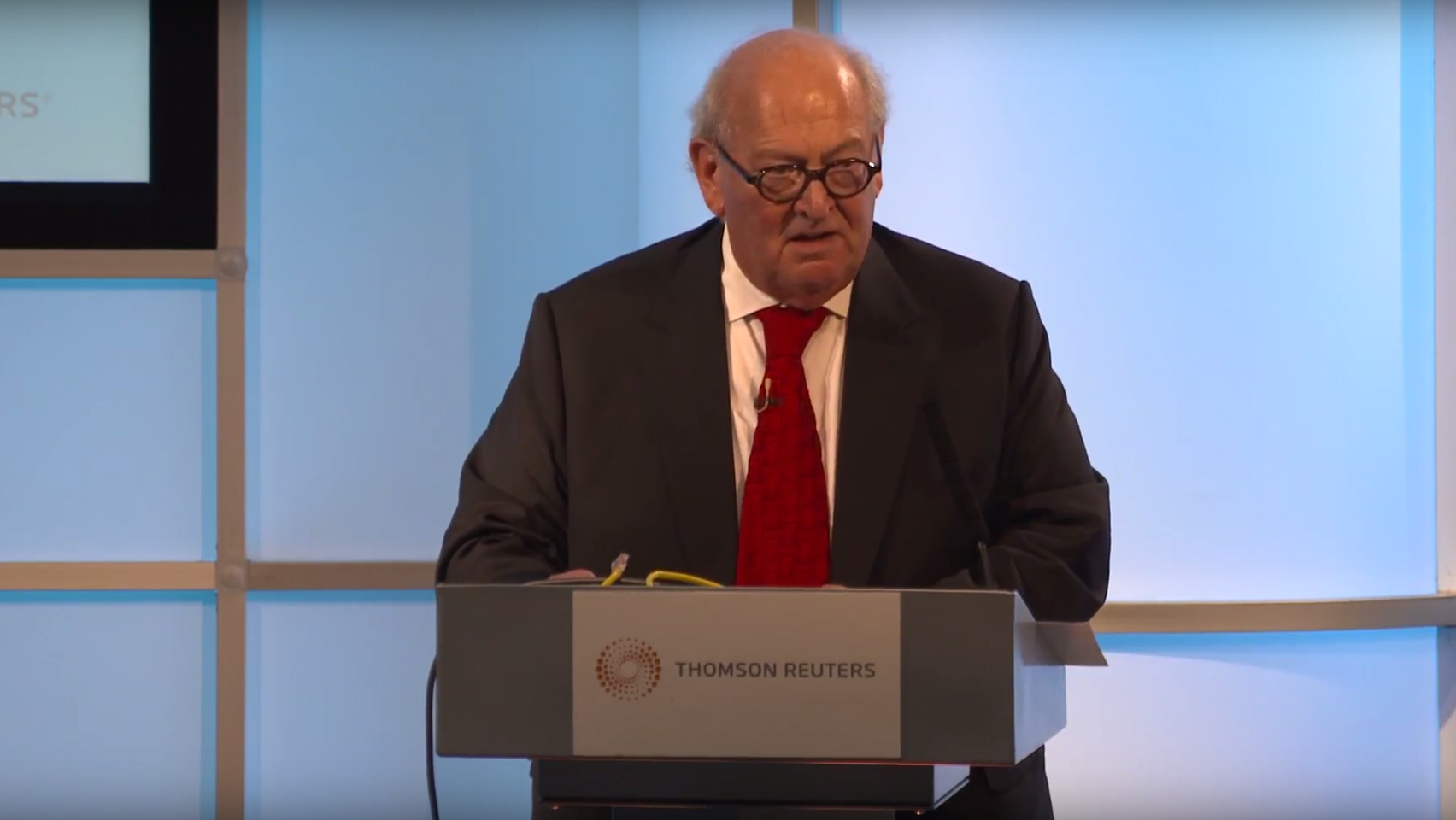

Opening the debate and arguing for the motion, David Goldberg, QC, Gray’s Inn, was first allowed to define terms, outlining what he believed the definition of a tax haven status was. He concentrated on two features; taxing only income which arises within its own border and that the tax system is clear, concise, easy to operate and can be seen to balance the rights and obligations of the citizens and the state.

“It used to be possible to an English common lawyer to go abroad, knowing that he or she came from a country which created the finest legal system the world has ever seen and gave it the guiding principles of the rule of law. We could be proud to fly our flag. Now it is stained by the sins against those beacon lights which are committed presently and most clearly by our tax system and which bring with them the risk of infecting other areas of law…”

– David Goldberg, QC, Gray’s Inn

Focusing on the current UK tax code he described it as a hideous tax system, a mean, complex and nasty piece of work, comically comparing the 50,000 odd pages of mostly bombastic drivel with the streamlined simplicity of the German equivalent. David was able to paint a complex, frustrating and frightful picture of our government’s oppressing intervention of our tax system, which he felt must be changed to be simpler and clearer for Britain to be worthy of the adjective ‘Great’.

The darker side of tax havens

First to argue against the motion was Joanna Perkins, CEO, Financial Law Committee. Joanna brought 15 alliterative arguments to the debate, covering political constraint and why a tax haven status would be wrong for the UK economy.

Focusing on the key points of Brexit negotiations; immigration and free-trade partnerships, Joanna argued that we cannot have our post-Brexit tax haven cake and eat it too, pointing out the short truth that restricting immigration and attracting foreign investment are like oil and water, that companies take their capital to wherever skills are plentiful and available at competitive labour wages. Simply put, removing competition for the labour market would undermine any incentives created by tax breaks. Regarding the belief that free-trade deals are essential for a successful post-Brexit Britain, Joanna highlighted that free-trade partners don’t want deals with a deregulated economy.

“The only companies that want to buy hormone injected beef or dodgy financial products, are countries themselves who have lower food standards or less robust financial regulation. “

– Joanna Perkins, CEO, Financial Law Committee

Joanna went on to look at the potential damage to the economy, calling out the tax haven status strategy. Her belief was that it can only lead to increased public debt, a higher level of pay demands and increased risks in the financial system, due to light-touch regulation. Joanna also looked to woo the audience with the threat that lower tax rates could see even further funding cuts to public services; something that we’ve recently seen, hits a nerve with Britons.

Closing her argument Joanna again attempted to stir an emotional response from the audience, delving into the darker side of a tax haven status, highlighting the potential of attracting dirty money, corruption, mobsters, terrorists and extortionists. Something we don’t want, or need.

The key to remaining great, in keeping up to date

Following on from Joanne, Douglas Carswell, Former MP, hit back with a strong case that we currently live longer, happier and healthier lives than ever before and although we’re not in a utopia, we are also certainly not in dystopia. Therefore, we don’t need to be great again as we’re already great. What we need to do is to make things better.

Douglas argued that we’re currently living beyond our means with an economic strategy focused only on the short term and to make the things better we need to look to open up the UK’s economy to the world, focusing on trade deals in areas of financial growth within the 165 non-EU states.

For Douglas, Brexit offers an opportunity for us to take back control and make change for the better, with an open economy, lower taxes and simplified tax system aimed at attracting and welcoming new wealth creation.

“Post Brexit, we need to make sure the UK a place where capital and talent fly to and not a place where capital and talent fly away from.”

– Douglas Carswell, Former MP

Reminding the audience that we’re now living in a digital age where wealth creation has moved from factories making ‘stuff’ to hyper-mobile intellectual property and therefore we also need to also move on from 1950’s thinking.

Regulation matters and taxes are needed

Throughout the majority of journalist and former politician, Chris Huhne’s, argument against the motion, there was an overwhelming feeling that he was in constant disbelief that creating a tax haven status for Britain could be considered at all ‘barking mad!’

From beginning to end of his 10 minutes, Chris held nothing back, including David Goldberg’s salary. He initially directed his attention at the benefits of quality, regulation and taxes, commenting that “Regulation matters and taxes are needed to pay for a civilized society.”

Addressing his competitors as “Brexit fantasists”, he rebutted Douglas’ previous point of ‘focusing on growth areas outside of the EU’, Chris commented that they were simply ignoring the concept of geography, the costs that come with transport, and the fact that the EU is not currently preventing Germany from exporting over four times as much as the UK to China. Asking the question on what difference Brexit will have?

“Transport costs matter, we trade more with the Republic of Ireland than we trade with both India and China combined.”

– Chris Huhne, journalist and former politician

Chris continued a passionate address, highlighting that the UK is currently not highly taxed and has been a key mover and shaker in the clamping down of tax evasion. To U-turn on thirty years of progression in this area would require not only the support of the country (support they’re unlikely to get from the current Labour party) but also the support of the banks, and with recent high-profile prosecutions for facilitation of tax-evasion, getting this support seems like a pipe-dream.

But what does a tax haven status mean?

Following the final speaker for the opposition, the chair, Reuters Editor at Large Axel Threlfall, took the debate to the floor with questions from the audience. Up to this point of the debate it was quite obvious that people were still unsure of whether the debaters agreed on what was included in a tax haven status and by the end of the Q&A they were left still slightly confused, as neither side would budge on their definition. A key disagreement was whether bank secrecy was included.

Following the Q&A session, our debaters made their final closing statements, highlighting their key points in the hope to clinch the audience’s vote. And the result? We saw a complete 360 from the initial audience vote, with 68 per cent now against the motion and therefore deciding that developing a post Brexit tax haven status will not make Britain great again.

Watch the full recording of the debate here.

Arguing for the motion were David Goldberg QC, Gray’s Inn Tax Chambers, and Douglas Carswell, Former MP. Arguing against the motion were Dr Joanna Perkins, CEO of the Financial Markets Law Committee, and Chris Huhne, Journalist and former politician. The debate was chaired by Axel Threlfall, Editor at Large, Reuters.